[ad_1]

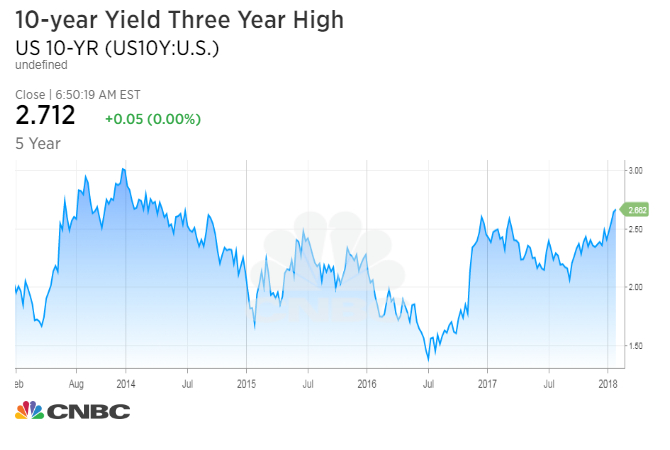

The yield on the benchmark 10-year Treasury note surged to 2.716 percent on Monday, its highest since April 2014, as investors bet on an accelerating economy and inflation.

A falling dollar this month has also helped drive yields higher as traders worry it may reduce the appetite for Treasurys, while boosting inflation. The 10-year yield ended December at 2.43 percent.

The yield on the 30-year Treasury bond was higher at 2.954 percent. Bond yields move inversely to prices.

“The overnight move clearly sets the stage for 2.8 percent on the 10-year and starts to put 3 percent on the table,” wrote Peter Tchir of Academy Securities in a note Monday. “This is a global bond sell-off, some part of which is linked to the realization that the combination of the Federal Reserve and European Central Bank is slowly shifting from quantitative easing to neutral in the near term and actual combined balance sheet reduction later this year.”

Data will drive trading Monday and the rest of the week.

The Fed’s policy-setting arm — the Federal Open Market Committee (FOMC) — will make a decision on interest rates on Wednesday. Though the central bank is widely expected to maintain the status quo, the meeting will be the last official meeting for current Fed Chair Janet Yellen. The FOMC expects to hike interest rates multiple times this year with Jerome Powell as its new chief.

The At 8:30 a.m. ET, personal income and outlays are due out, followed by the Dallas Fed’s Texas Manufacturing Outlook survey at 10:30 a.m. ET. January’s jobs data will be out on Friday.

Investors also monitored currency markets on Monday.

The dollar swung wildly last week, as President Donald Trump and Treasury Secretary Steve Mnuchin offered seemingly conflicting views on the strength of the currency. Mnuchin originally seemed to favor a weaker dollar, saying “a weaker dollar is good for us as it relates to trade and opportunities,” sending the euro soaring against the dollar.

But Trump quickly corrected the Treasury Secretary, saying he eventually hopes for a “strong dollar” as economic activity improves, providing the greenback with stability on Thursday.

When the dollar depreciates, the price of foreign goods increase relative to domestically priced goods, making imports more expensive, leading to an increase in inflation in the U.S. Increasing inflation, in turn, undermines the real value of each coupon payment from holding debt, driving down prices.

[ad_2]

Source link