On December 12, 2024, Chainlink (LINK) seems to be in the eyes of both whales and institutions, leading to a notable price surge in the past 24 hours. According to a whale transaction tracker on X (formerly Twitter), significant accumulation has been reported, ranging from wallet-linked Trump to whales.

Whales and Institutions Rising Interest in LINK

During the Asian trading hours, Eyesonchain, a blockchain-based transaction tracker made a post on X that Trump’s World Liberty Financial acquired a significant 41,335 LINK, worth $1 million. This notable purchase was made at an average price of $24.19.

Additionally, another blockchain-based transaction tracker Lookonchain made a post on X that a whale had invested a substantial 1,263 ETH worth $4.95 million to acquire 175,424 LINK tokens at an average price of $28.18 level.

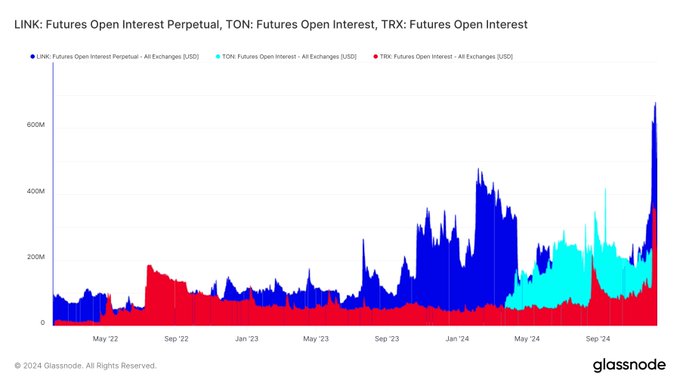

These two substantial acquisitions in less than 12 hours have gained widespread attention from the crypto community, resulting in a record jump in price and future open interest (OI).

According to the on-chain analytics firm Glassnode, LINK’s price has jumped to its highest level in the past two years, while its future OI has reached an all-time high of $770.27 million.

Current Price Momentum

Currently, LINK is trading near $28.23 and has registered a price surge of over 18.5% in the past 24 hours. During the same period, its trading volume jumped by 65%, indicating heightened participation from traders and investors amid ongoing whales and institutions participation.

Chainlink (LINK) Technical Analysis and Upcoming Levels

According to expert technical analysis, LINK is currently facing strong resistance near $29 and is attempting to breach this level. With significant institutional interest, crypto whales, and trader confidence, there is a strong possibility it could break through this level in the coming days.

Based on the recent price action, if LINK breaches this level and closes a candle above $29.50, there is a strong possibility it could initially soar by 20% to reach the next resistance level of $35, and later surge by 80% to reach the $52.50 level, which is its all-time high.

However, traders and investors need to understand that LINK has significantly stretched on both the weekly and daily time frames. There is also a possibility of a price correction during the upcoming rally, which could provide support for LINK in its bull run.