- The Canadian Dollar is mostly flat near familiar territory on Thursday.

- Canada GDP figures due Friday to draw some attention from Loonie traders.

- Market volumes are notably thin with US markets shuttered for Thanksgiving.

The Canadian Dollar (CAD) traded thinly on Thursday, sticking to the 1.4000 handle against the Greenback as global markets grind into slow gear in the latter half of the trading week with overall market volumes crimped by a lack of flow from US institutions. US markets are shuttered in observation of the Thanksgiving holiday today, and a shortened day for American markets on Friday also bodes poorly for consistent market moves to wrap up the week.

Canada will be printing updates to Gross Domestic Product (GDP) growth figures on Friday, leaving Loonie traders in the lurch for Thursday. Still, Canadian Current Account figures came in better than expected, helping to muscle the CAD into a slightly higher stance on the day.

Daily digest market movers: Canadian Dollar propped up by holiday markets

- The Canadian Dollar gains a scant tenth of a percent on Thanksgiving Thursday.

- Market flows have dried up with the US on holiday. Friday volumes will likely be constrained as well.

- Canada’s Current Account came in at -3.23 billion in the third quarter, better than the expected -9.3 billion and rebounding from the previous quarter’s revised -4.7 billion, which was initially released at -8.4 billion.

- On Friday, Canada’s third quarter GDP growth is expected to ease to just 1.0% on an annualized basis, down from the previous 2.1%.

- On a month-on-month basis, Canadian GDP is forecast to swing up to 0.3% MoM in September compared to August’s flat 0.0% print.

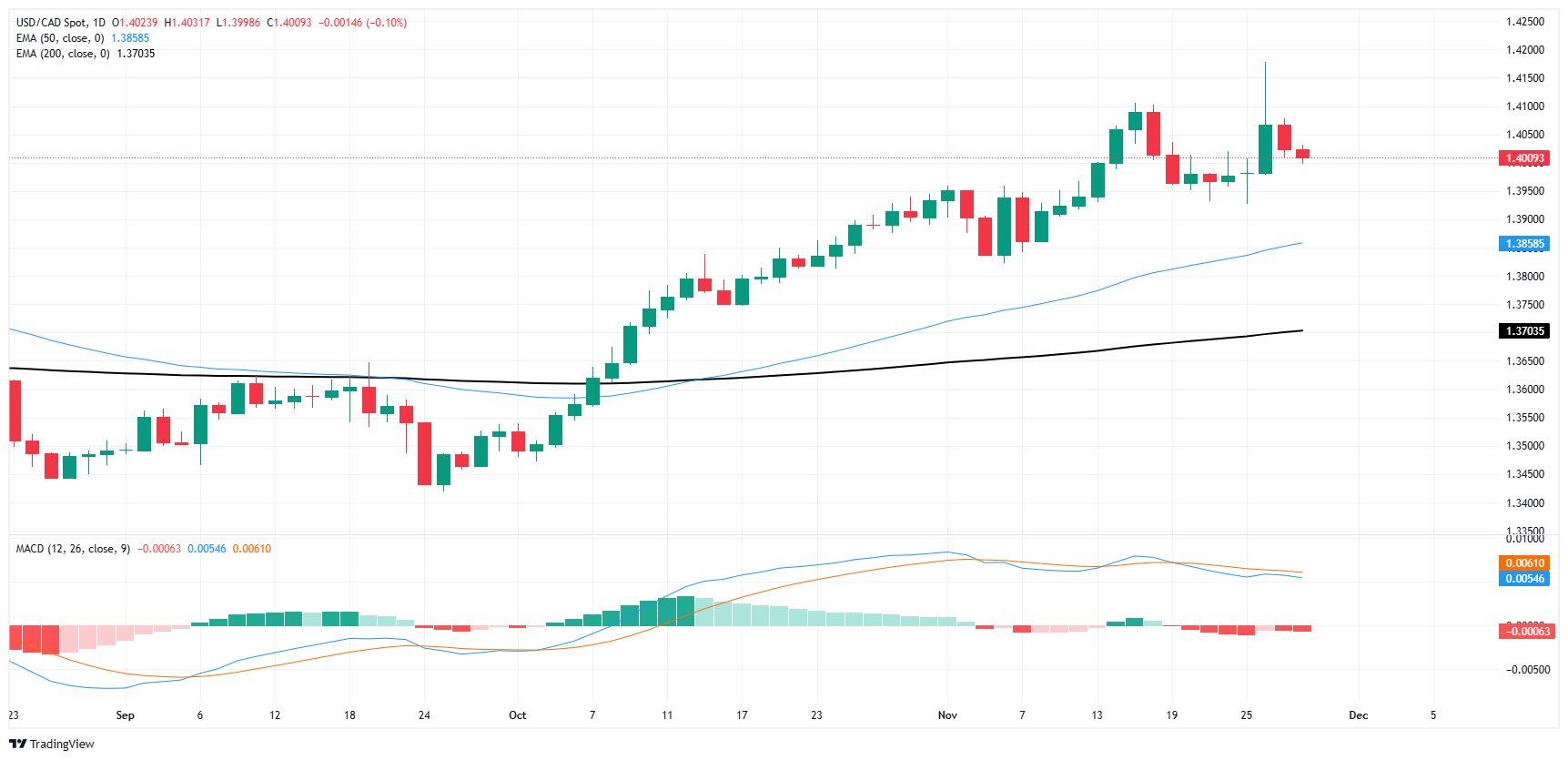

Canadian Dollar price forecast

The Canadian Dollar’s (CAD) is seeing a tepid rebound after tapping a 55-month low this week. The CAD has gained an intraday foothold against the US Dollar, dragging the USD/CAD pair back into the 1.4000 handle. The pair is still caught on the high end following a broad-market bull run in the Greenback. Still, technical traders will have an increasingly difficult time ignoring the growing potential for a cyclical turnaround in the long-term charts.

USD/CAD daily chart

Economic Indicator

Gross Domestic Product (MoM)

The Gross Domestic Product (GDP), released by Statistics Canada on a monthly and quarterly basis, is a measure of the total value of all goods and services produced in Canada during a given period. The GDP is considered as the main measure of Canadian economic activity. The MoM reading compares economic activity in the reference month to the previous month. Generally, a high reading is seen as bullish for the Canadian Dollar (CAD), while a low reading is seen as bearish.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.