![]()

contributor

Share this article

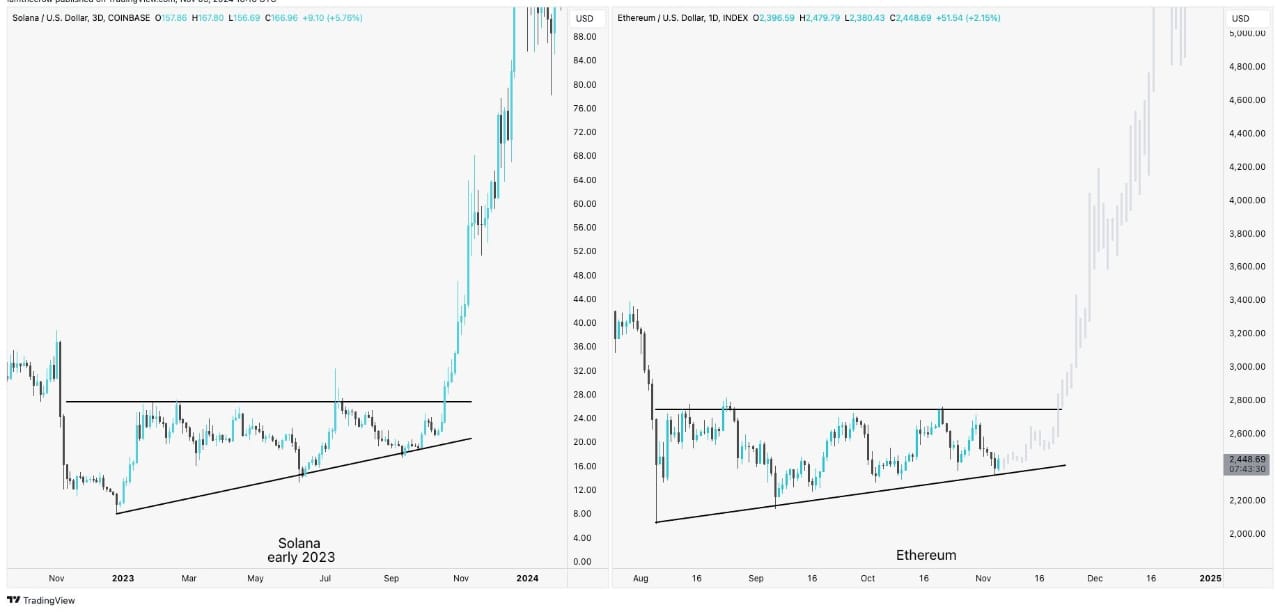

- Ethereum mirroring Solana’s exact structure, a triangle below its resistance level.

- The multiple liquidity grab that occurred on ETH could spark a rally.

The comparison of Ethereum [ETH] and Solana [SOL] charts reveal a notable similarity between the recent price action of ETH and that of SOL in early 2023.

Solana’s price in early 2023 formed an ascending triangle, consolidating beneath resistance before ultimately breaking out, resulting in a substantial rally of over 222%.

As of press time, Ethereum was mirroring this exact structure—forming an ascending triangle beneath its resistance level, showing similar buildup and consolidation.

Given this pattern alignment, Ethereum could potentially be on the cusp of a major bullish breakout if it follows the same trajectory as Solana did.

The ascending triangle often traded as a bullish continuation pattern suggests a breakout could propel ETH significantly higher. Momentum indicators and trader activity would need to align for ETH to achieve comparable gains.

Should Ethereum break above the current resistance zone, it might lead to a strong rally, targeting similar upside percentages, positioning ETH for another significant uptrend.

The RSI and MACD indicators suggest…

Additionally, the Ethereum the relative strength index and moving average divergence convergence indicators points towards potential market strength.

The RSI was hovering near a neutral to slightly bullish territory, suggesting momentum may start leaning upwards. The histogram for the MACD indicator was showing diminishing red bars, hinting that bearish pressure could be weakening.

Additionally, the MACD line appears to be nearing a crossover above the signal line, which is a common bullish signal.

Overall, these indicators imply that ETH might experience some buying momentum if more fundamentals like liquidity grab and on-chain activities surge in line with price patterns.

The impact of the liquidity grab on ETH price action

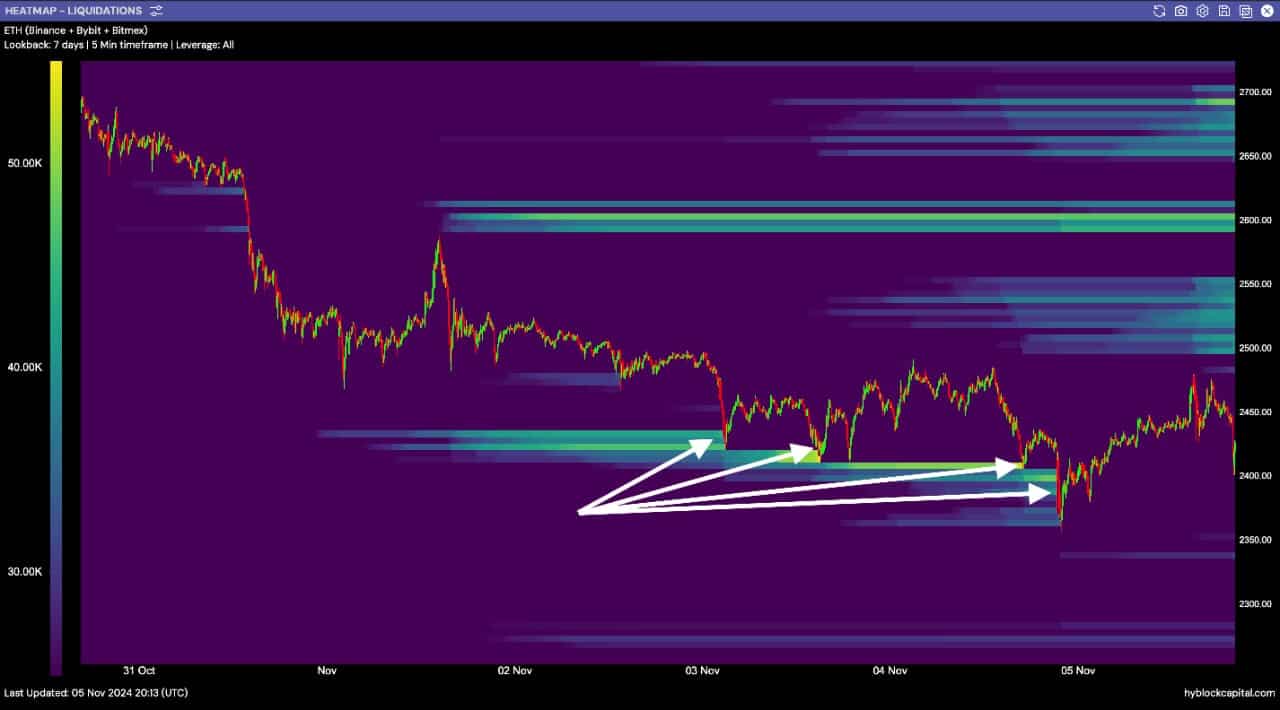

Looking at the ETH liquidity heatmap clearly indicated a familiar pattern: another day marked by a strategic liquidity grab.

Price action consistently reached down to absorb liquidity, creating a series of wicks that suggested market makers and larger players were shaking out weaker hands.

The scenario appeared poised for ETH to rebound after this liquidity grab, especially as there remains a significant cluster of liquidity in close proximity above the current price.

Read Ethereum’s [ETH] Price Prediction 2024–2025

These higher liquidity levels act as magnets, making it likely that Ethereum will aim to move upward next, targeting those areas. This could potentially lead ETH to gaining similar 222% gains as SOL.

Traders can anticipate that ETH, following this liquidity sweep, may leverage the regained momentum to climb and capture the nearby liquidity pools, leading to potentially bullish short-term movement.