[ad_1]

The Bank of England lifted its forecasts for economic growth and suggested it may need to raise interest rates faster than previously indicated.

The Monetary Policy Committee, led by Governor Mark Carney, sees the U.K. growing quicker than its sustainable pace through 2020, meaning there’s a greater risk of overheating. Inflation is projected to remain above the 2 percent target under the current yield curve, which prices in about three quarter-point hikes over the next three years.

The MPC agreed that “monetary policy would need to be tightened somewhat earlier and by a somewhat greater degree over the forecast period than anticipated at the time of the November report,” according to the minutes of its latest meeting published on Thursday.

The BOE’s outlook meshes with signs that synchronized global growth will lead to the end of the loose monetary policies pursued by central banks since the financial crisis a decade ago. Concerns that investors might have underpriced the likelihood of higher borrowing costs to keep inflation under control helped spark a global stock selloff in recent days.

The pound jumped after the announcement and was up 0.7 percent at $1.3978 as of 12:13 p.m. London time.

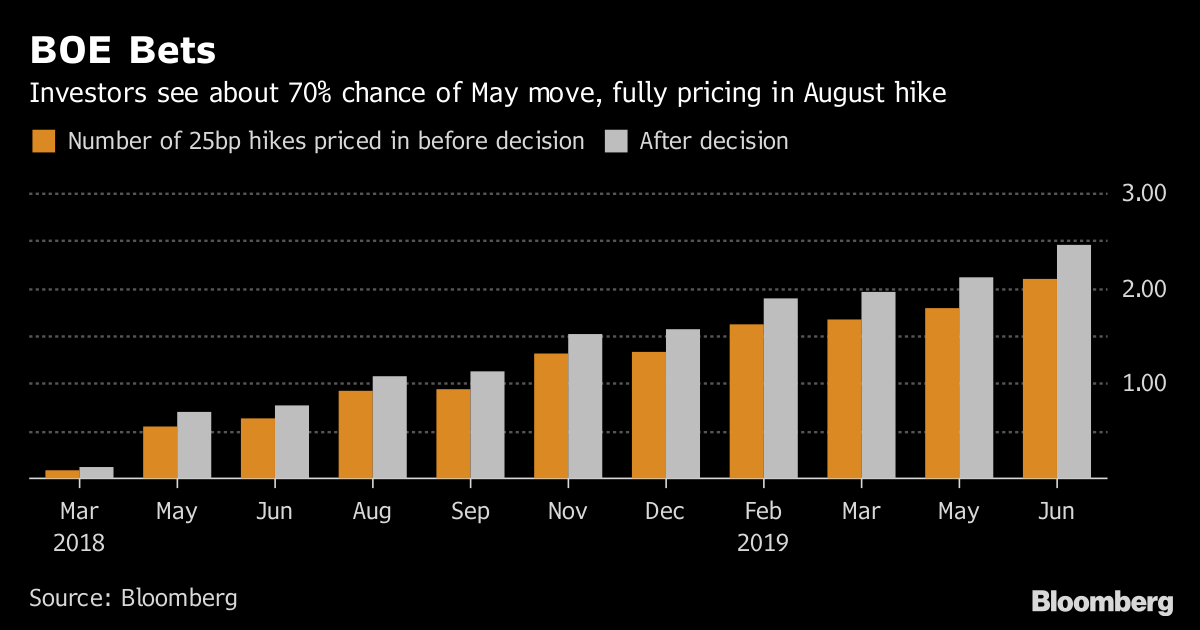

The comments boosted market expectations of a U.K. rate hike as soon as May. Investors are now pricing a 70 percent chance of such a move by then, up from 55 percent before the decision. A hike by August is fully priced in, with another increase seen in May 2019.

BOE Bets

Investors see about 70% chance of May move, fully pricing in August hike

Source: Bloomberg

The new outlook from the BOE came as it left the benchmark interest rate unchanged at 0.5 percent. The vote was unanimous, though there was speculation that one or two of the nine policy makers would vote for a hike.

What Our Economists Say:“The big question for the Bank of England this meeting was whether the steepening of the yield curve since November would be enough to curb the stronger growth outlook. The answer, Carney and his colleagues think, is no. Bloomberg Economics expected a rate hike to come in August, this strengthens our conviction and tilts the risks to May rather than November.” –Dan Hanson, Bloomberg Economics |

In its updated forecasts, the BOE sees growth at 1.8 percent this year and next, up from its November projections. While consumption will remain weak and Brexit is damping investment, global demand is helping U.K. trade, it said.

Brexit Uncertainty

Policy makers also reiterated that a range of Brexit outcomes are still possible. Those developments “remain the most significant influence on, and source of uncertainty about, the economic outlook,” they said in the Inflation Report.

The central bank cut its estimate of the equilibrium unemployment rate, or the lowest level of joblessness that won’t trigger quicker wage gains, to about 4.25 percent from 4.5 percent. The current rate is 4.3 percent.

It warned there’s little spare capacity left to burn, and the economy’s speed limit, or the rate it can expand without fanning inflation, has dropped to about 1.5 percent since the Brexit vote.

Because of that, all the slack left in the economy will be eroded within two years and excess demand will then start to build.

Goal Horizon

Since the vote to leave the European Union in June 2016, the BOE has said it could tolerate faster inflation driven by the weaker pound to support growth. While it had previously stretched its horizon, seeking to return inflation to target over three years, the stronger growth projection means they are now aiming to get inflation to the goal in two years.

In a letter to Chancellor of the Exchequer Philip Hammond explaining why the inflation rate had deviated from target, Carney wrote “the prospect of a greater degree of excess demand” had “further diminished the tradeoff” that policy makers could accept.

The economy’s scope to comfortably expand has been curtailed because of weak productivity over the past decade. Brexit has added an additional pressure by suppressing investment.

The bank sees inflation at 2.2 percent in the first quarter of 2020 — above the 2 percent goal — further indicating it will need to tighten policy faster.

— With assistance by Harumi Ichikura, Zoe Schneeweiss, Paul Gordon, and Andrew Atkinson

[ad_2]

Source link