[ad_1]

Key Highlights

You have probably read the headlines, but I am going to refresh your memory. Alibaba (BABA) beat on revenue – $12.76B (+51.5% Y/Y) vs. expectations of $12.36B – but missed on EPS – $1.63 vs. $1.67.

This is the ninth quarter of higher than expected revenue in a row, although the company missed on EPS, which happens very rarely.

Guidance for Q4 was strong – management expects revenue to grow 55%-56% Y/Y compared to the previous forecast of a 53% increase. The strong guidance is much above the market’s expectations of a 50% Y/Y increase.

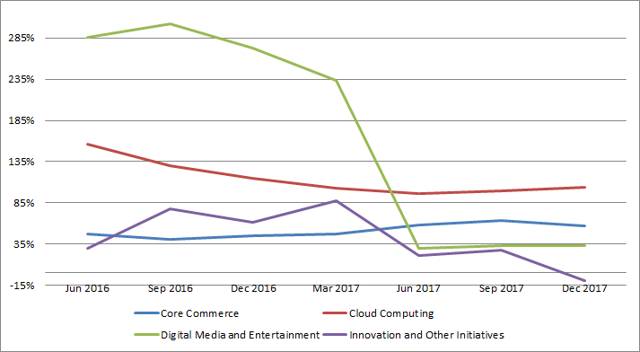

A first look at each division’s performance confirms they are almost all in pretty good shape. I am pleased with the strong momentum of the Cloud Computing division, which continues to grow at triple-digit rates (+104% Y/Y), and the core commerce business is showing ongoing strength despite the large scale, with a 57% Y/Y growth. Digital Media & Entertainment was also strong with a 33% Y/Y increase. The only disappointment came from the Innovation & Other Initiatives division, which reported a 6% decline in revenue Y/Y.

Source: Author’s Elaboration

Margins contracted slightly more than the market expected but I don’t see it as a problem. The management warned that the investments in New Retail Businesses such as Hema, Intime and Tmall import would have compressed margins but lead to higher profit dollars in any case. According to the press release, global expansion and the consolidation of Cainiao Network exerted some pressure as well.

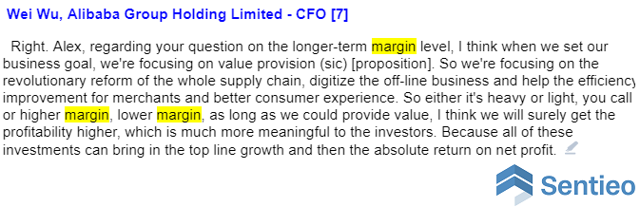

Operating margin contracted 800 bps to 31% while adj. EBITDA margin contracted 600 bps to 44%. This confirms a trend started in 2014, the time when margins began to decline. The margin dilution continued partly because of the high investments, partly because of the business model expansion towards more asset-heavy ones, such as Hema, Intime, Tmall import and so on. The management often stated pretty much clearly that the focus is not on marginality, but rather on top-line growth and profit dollars. As a reference, see what they answered when JP Morgan’s Alex Yao asked a question about the long-term margin goal:

Source: Q2 Earnings Call

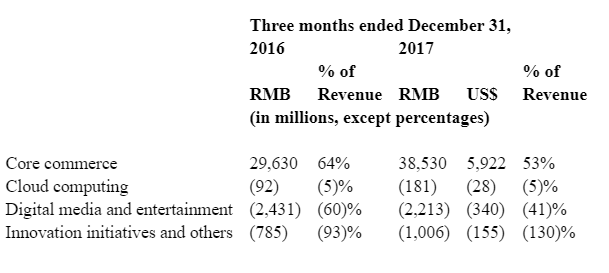

I am only a bit disappointed by the lack of margin expansion in the Cloud Computing division while the Digital Media & Entertainment division reported a decline in losses in absolute and percentage terms:

Source: Press Release

Nonetheless, we know Alibaba is pushing international growth for its Cloud computing business and that requires high investments for sure. To clear all doubts, we can read in the press release:

As many of our newly developed and acquired businesses have different cost structures and lower margins, we expect that our margin will continue to be negatively impacted by these new businesses.

This is not going to be a problem, but we will see this later in the article.

A Deeper Look Into The Core Commerce Division

Revenue from core commerce increased 57% year-over-year to RMB73,244 million (US$11,257 million), which indicates only a slight deceleration on a 2-year stacked basis despite the division’s much larger scale. Alibaba’s core commerce business continues to show massive growth rates that go well beyond the industry’s growth rate and the competitors’ performance.

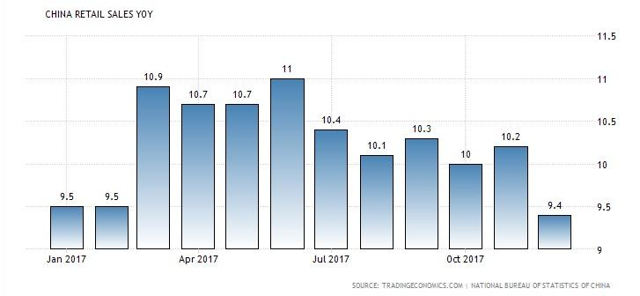

The company’s growth continues to be much faster than what we have recently seen with Amazon (AMZN) or any other eCommerce player in the west, which can be partly explained by the faster growth rates in the Chinese retail sector and the lower penetration of eCommerce in the country. China dwarfs any western economy in terms of retail sales growth:

Source:tradingeconomics.com; National Bureau Of Statistics Of China

This doesn’t justify the growth gap vs. competitors like JD.com, which we could think is more a result of Alibaba’s international expansion while JD remains a “domestic” company at the moment.

While it’s true that Alibaba’s commerce division’s growth extends well beyond China through its platforms Alibaba.com, Aliexpress and Lazada, the Chinese business continues to grow at massive rates. The health and scale of Alibaba’s growth are not just crystal clear when we look at revenue growth numbers but are confirmed by the outstanding growth numbers in terms of active consumers and MAUs:

- Annual active consumers of China retail marketplaces reached 515 million, an increase of 27 million from the 12-month period ended September 30, 2017. This translates into a 5.5% Q/Q increase and implies an acceleration from the 22 million added last quarter (+4.5% Q/Q).

- Mobile MAUs for China retail marketplaces reached 580 million in December 2017, an increase of 31 million over September 2017. This translates into a 5.6% Q/Q increase, which reflects an acceleration after a 20 million increase (+3.8% Q/Q) from the previous quarter.

The core commerce business remains strong and is growing fast through every channel the company is operating in.

Cloud Computing

Alibaba remains the largest player in the cloud computing market in China and is estimated to be servicing more than 30% of websites in China. The division grew 104% year-over-year to RMB3,599 million (US$553 million), driven by growth in paying customers and a shift in revenue mix toward higher value-added products.

In the past, the management has stated that the cloud computing business’s top priority remains expanding market leadership and upselling higher value-added services. While the company doesn’t disclose revenue per user, they said the segment’s growth was primarily driven by an increase in the number of paying customers and also by an increase in their usage of the cloud computing services including more complex offerings, such as database, storage and security services. This suggests revenue per customer is trending up although we don’t know the actual numbers.

I am a bit disappointed by the total lack of margin improvement despite the strong top-line growth in the division and the apparent higher revenue per user, which doesn’t seem to help. Adjusted EBITA was a negative RMB181 million (US$28 million), compared to a loss of RMB92 million in the same quarter of 2016. Adjusted EBITA margin remained stable at negative 5% compared to the same quarter in 2016. Despite a little bit of disappointment for not seeing any margin improvement with a such a strong top-line growth, the management made it clear in the past that margin expansion is not a priority.

Digital Media & Entertainment

It’s good to see a combination of strong growth and margin improvement in the Digital Media & Entertainment division. Adjusted EBITA was a negative RMB2,213 million (US$340 million), compared to a loss of RMB2,431 million in the same quarter of 2016. Adjusted EBITA margin improved to -41% from -60% in the quarter ended December 31, 2016, primarily due to “improved results from UCWeb and other media and entertainment businesses, partly offset by an increase in investment in content costs of Youku Tudou”.

I can’t compare the division’s performance to Baidu’s iQiyi (BIDU) or Tencent Video (OTCPK:TCEHY) (OTCPK:TCTZF) since those companies will release results for the quarter later than Alibaba, but I am pleased to see a smaller loss in absolute and percentage terms despite the high investments in content.

The DM&E industry is highly competitive in China. Alibaba’s Youku faces fierce competition from the aforementioned platforms in a context of “run for the first place”. The streaming industry in China is relatively underpenetrated and doesn’t show a huge market-share gap between the leader and the laggards, as opposed to what we can see in the western economies, where Netflix dominates. None of the internet giants in China is willing to give up and all of them continue to invest large sums in the development of proprietary content, which is seen as a positive driver of customer engagement/retention and a positive driver of margin expansion in the long term, despite the high initial investments.

I think we can’t expect the division to be profitable anytime soon, as competition is too fierce at the moment, although it’s reasonable to expect losses to decline unless internet giants start to engage in price battles.

Stake in Ant Financial

Alibaba agreed to take a 33% equity stake in Ant Financial, acquiring newly-issued Ant Financial equity in exchange for certain IP rights. The direct participation will replace the current profit-sharing agreement that had Ant paying service fees equal to 37.5% of its pre-tax profits, subject to certain adjustments.

In financial terms, there won’t be any cash impact to Alibaba and I don’t see particular consequences worth mentioning. Alibaba and Ant Financial were partners before and will continue to be partners under the new arrangement, but Alibaba’s equity ownership in a company that is a key player in its ecosystem is supposed to have positive strategic implications. During the earnings call, the management declared an equity stake in ant financial should bring many strategic benefits:

#1, advancing our new retail strategy with mobile payments; #2, increasing user acquisition and retention through collaboration with the Alipay Digital Wallet; #3, enhancing the execution of our international expansion; and #4, enabling Alibaba and our shareholders to participate in the future growth of the financial sector.

We will see. In any case, Alibaba will have significant governance rights in Ant Financial through board representation, which should guarantee the two companies’ interests will be aligned. Other than that, the financial impact of this transaction is negligible in the short term but potentially significant in the long term.

Updates on new retail strategy

In a recent article, I shared my thoughts on Alibaba’s ventures in the “New Retail” business. I see these ventures as a strong and underappreciated growth driver for BABA. Nonetheless, I see the attention on these aspects has increased and reached a new high this quarter.

According to data from Sentieo.com, “new retail” was mentioned 27 times in Q3’s earnings call, against 17 times in Q1 and Q2 and just 3 times in Q4 2016.

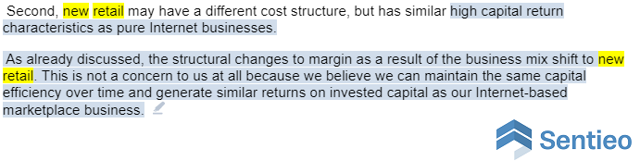

In the earnings call, the management gave us some important indications about the division’s prospects. In the first part of the article, I mentioned the constant decline in margins as a result of an increasing shift to more capital-intensive retail concepts such as Hema or Intime. Nonetheless, the management is sure that this won’t have a particularly negative on bottom-line growth since new retail may have a different cost structure but has similar capital return characteristics as pure Internet businesses. In the management’s own words:

If ROIC is similar, then there would be no negatives in the expansion New Retail. Alibaba is probably the company with the best positioning to push the penetration of this new business concept thanks to its scale advantage, customer base, experience in digital commerce and advanced cloud and AI infrastructure. This business continues to be an excellent long-term growth option thanks to the apparently favorable capital returns, despite the lower marginality.

Conclusion

The December quarter showed good results that don’t justify the 6% decline I am seeing while I am writing this. This is short-term noise that doesn’t reflect a weaker bullish thesis. Alibaba continues to crush growth estimates and raise guidance above the market’s expectations.

The long-term picture remains favorable thanks to the strong secular growth in every division and the further optionality offered by the New Retail ventures. Margins will continue to be in a downtrend but growth in profit dollars will remain at strong levels. The margin pressure of the more capital-intensive concepts in the New Retail business can be in part offset by the margin expansion in the Cloud Computing and Digital Media & Entertainment businesses once they reach critical mass and the focus shifts from sales growth to profitability.

I don’t see anything that should make me change my bullish stance. Alibaba remains a concept with a huge growth potential and an excellent pick for the long term.

Disclosure: I am/we are long BABA, BIDU.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

[ad_2]

Source link