[ad_1]

Snapchat doubled its Rest of World revenue this quarter. That’s a surprise, considering CEO Evan Spiegel never seemed to care about anyone but U.S. teens. Snapchat’s Android app was buggy. Its videos loaded too slowly on weak connections. And Spiegel even admitted “Historically we’ve really focused our efforts on markets where [high-end phones and broadband mobile networks] are available.”

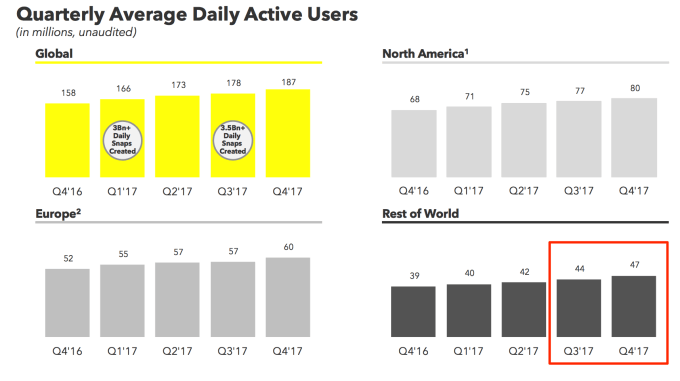

That left the door wide open for Instagram Stories and WhatsApp Status to steal the international market before Snap could arrive. In Q4 2016, Snapchat total users in the Rest of World stayed worryingly flat at 39 million.

But Spiegel changed his tune this year with a massive set of strategy flip-flops. Three months ago he admitted that “In order to further scale our user base, we need to accelerate the adoption of our product among Android users . . . and users in the Rest of World markets.” This acknowledgement that more than California cool kids like him mattered now appears instrumental to the Second Coming of Snapchat.

Today, Snap Inc. recorded a blockbuster quarter, reviving its growth rate from 2.9 percent to 5 percent as it reached 187 million daily users. Revenue blew away expectations and losses shrank. And the share price soared up 21 percent in response.

Dig a little deeper, though, and it’s clear where Snapchat’s renewed strength came from. The developing world.

The Rest of World region added 3 million daily users to reach 47 million, just as many as the European and North American markets despite their larger size. That’s more developing world users than it’s added in any quarter since the frothy growth days of Q1 2016.

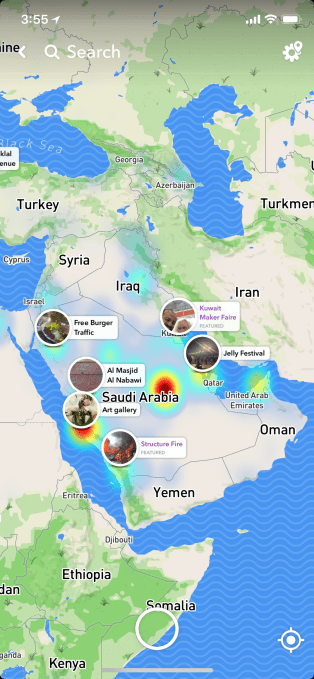

The Middle East was a top contributor to Snap Inc’s revenue this quarter

How did it add so many in countries across South America and Asia? First, Snapchat got serious about improving its Android app’s performance. Back in its IPO filing, Snap wrote that “although our products work with Android mobile devices, we have prioritized development of our products to operate with iOS.” But engineering advances led to a 20 percent increase in Android user retention, as fewer bugs kept users aboard. Spiegel said Snapchat now has its lowest crash rate ever.

Meanwhile, Snapchat launched partnerships with wireless carriers over a dozen markets to reduce the cost of all the data Snapchat scarfs up. “This is important because Snapchat can be more fun to use out in the world rather than at home on Wi-Fi,” Spiegel said. Though these “zero-rating” deals can be controversial for net neutrality reasons, they can make it much easier to recruit users. Engineering improvements also made video Snaps and ads easier to stream.

All this extra usage in the developing world was paired with much stronger monetization. Average Revenue Per User in the developing world nearly doubled, from $0.30 to $0.56, with total revenue from the region doubling quarter-over-quarter, from $13 million to $26 million. Year-over-year, Snap grew Rest of World revenue a staggering 333 percent.

That’s in part because 90 percent of Snapchat’s ads are now bought through the programmatic Ads API and self-serve Ads Manager interfaces rather than through sales people, versus 10 percent a year before. That eradicates the language barrier.

COO Imran Khan explained that “Our self-service tools have also enabled us to quickly scale in international markets. For example, in the Middle East, we made the strategic decision to rely exclusively on our self-serve tools for Snap Ads . . . and out of all our international offices, this region was our top contributor to overall revenue growth in Q4.” Code is the universal language, after all.

What we’re seeing is Snapchat International. While U.S. teens still might monetize better than those abroad, there’s a lot more scattered around the globe than here at home. It turns out kids everywhere want to chat and share without a permanent record. They weren’t opposed to Snapchat. They just wanted it to work right.

Snap is having a great day, and it owes it all to where it’s already tomorrow.

[ad_2]

Source link