[ad_1]

As we all know, AT&T (T) is set to purchase Time Warner (TWX) in a mega-merger. This, of course, is currently on hold while we await a trial in the United States regarding the merger. As such, we as shareholders of both companies need to monitor performance while operating under the assumption that the merger will not go through (though we fully believe it will). As such, we are going to examine the just reported Q4 earnings. In the present column, we offer discourse on trends in the critical performance metrics and demonstrate the impressive growth. Further, with tax reform now a reality, we update our 2018 projections for the company.

Top line growth driven by across the board segment improvement

Time Warner delivered performance that exceeded our expectations. In fact, it also surpassed analyst expectations as well. This is something we were hopeful we would see; outperformance against our projections. The performance bodes well for AT&T’s future with the company.

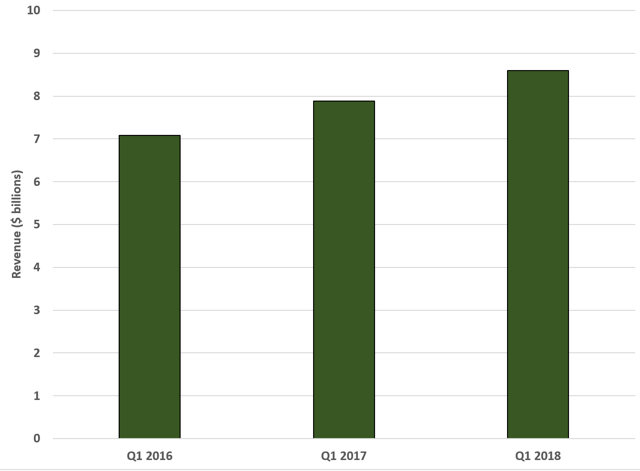

It was a strong quarter that saw across the board improvement. Every segment saw growth and this drove revenues up to $8.6 billion:

Source: SEC filings

This represents strong growth of 9%. But it’s just a headline number and doesn’t tell us much, so we have to dig deeper. It’s notable that these revenues surpassed our expectations by $110 million. That’s incredible for a global media giant of this size and is in large part due to strong performance in Turner and Home Box Office subscriptions, which saw revenues jump 13% and 11% respectively. However, one critical issue to be mindful of is the change in expenses when we see revenues rise at a large clip.

Expenses well managed

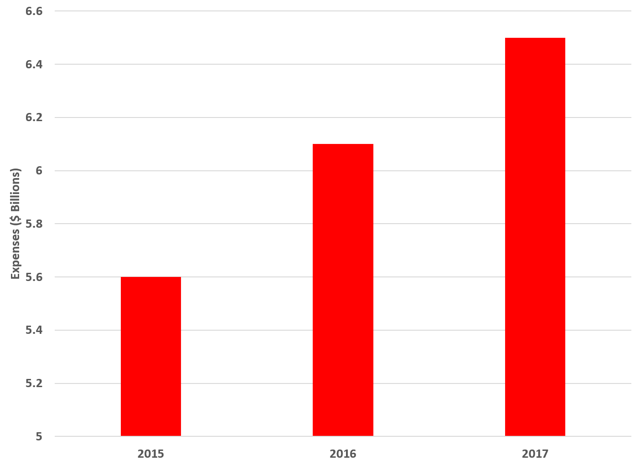

With the rise in revenues, we have to be on the lookout for expenses rising at a rapid clip weighing on margins. Well, compared with Q4 2016, operating expenses were indeed up, coming in at about $6.5 billion, rising from $6.1 billion last year:

Source: SEC filings

This year-over-year rise does not surprise us, and we were pleased that operating income expanded to $1.91 billion versus $1.69 billion last year. However, thanks to lower interest expense and a significant tax benefit, earnings were strong.

Earnings impress

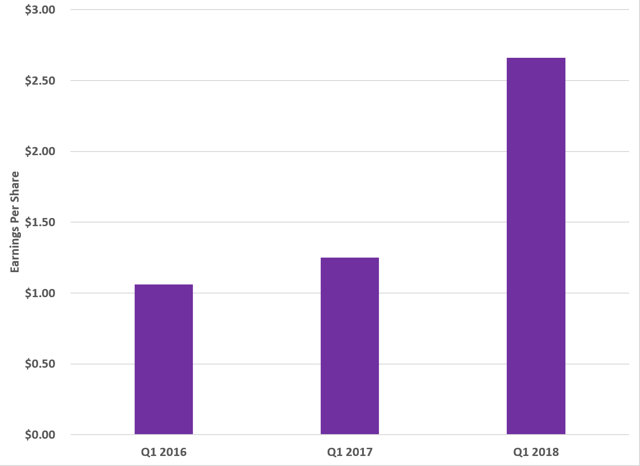

Taking into account revenues and expenses, as well as a $771 million income tax benefit, net income was $1.39 billion or $1.75 per share, compared to $293 million or $0.40 per diluted share in the year-ago quarter. But it’s a GAAP number, so factoring in premiums paid and costs incurred in connection with debt repurchases of $1.1 billion this quarter and $1.0 billion in the prior year quarter, adjusted earnings per share came in at $2.66:

Source: SEC filings

Of course, this compares to $1.25 last year and obliterated our estimates that were made before tax reform was a reality, so they are not comparable. Now, it must be noted that $1.07 of these earnings were related to a tax benefit from the Tax Cuts and Jobs Act. This means without tax reform, earnings per share still would have grown double digits. Simply outstanding, and the benefits of tax reform will continue next year.

Our 2018 projections

Continuing to operate under the expectation that AT&T will not close the Time Warner deal (again, we think it will), we are expecting 2018 to be another year of growth. Further, we think a boost in earnings per share will not only come from growth in operations but will, of course, grow thanks to tax reform.

Factoring in the outlook from the company, the trajectory of revenues, subscriber patterns as well as content performance, we are projecting revenues that will and are eyeing $8.75 billion to $9.0 billion. In either case, this is high single-digit movement compared to last year. As for 2018 earnings, we expect the per share number to improve based on rising revenues and moderate increase in expenses. With tax reform and other changes, we are expecting earnings in the range of $7.60 to $8.00.

Of course, all of this assumes there is no merger. The courts have set March 19, 2018, as the start date for the trial regarding the merger. Both Time Warner and AT&T have agreed to extend the termination date of the merger to April 22, 2018, and each has agreed to waive, until June 21, 2018, its right to terminate the agreement if the merger is not completed by April 22, 2018. So, we fully expect the deal to close, it’s just a matter of when and what provisions the courts will require.

Our take

Bottom line? 2018 is a big year, no question about it. The results from Time Warner are strong and should benefit AT&T should the merger close. Specifically, we are pleased that expenses have been well managed, leading to expanding margins, while performance is up across the board. While we are unsure when the merger will close, integrating Time Warner will take several quarters. Still, AT&T stands to benefit as it looks to become the world leader in global communications and media entertainment. If the merger doesn’t close, Time Warner is still a growth company we want to own.

Quad 7 Capital has been a leading contributor with Seeking Alpha since early 2012. If you like the material and want to see more, scroll to the top of the article and hit “follow.” Quad 7 Capital also writes a lot of “breaking” articles that are time sensitive. If you would like to be among the first to be updated, be sure to check the box for “email alerts” under “Follow.”

Disclosure: I am/we are long T, TWX.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link