[ad_1]

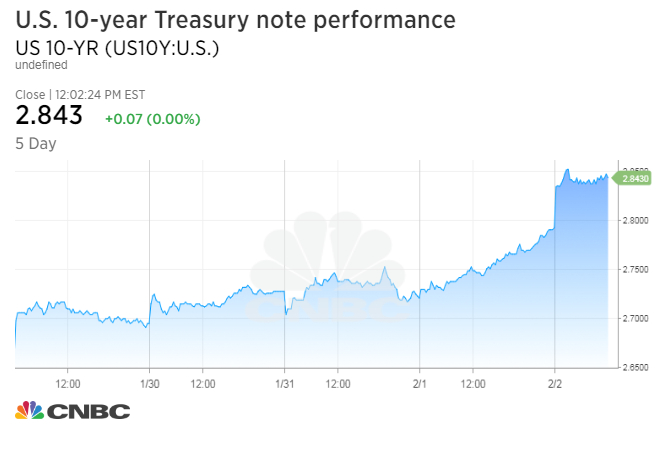

The 10-year Treasury yield jumped to a four-year high after a better-than-expected jobs report reflected rising wages. Yields also got a boost from higher-than-expected consumer confidence numbers as investors began to bet on accelerating inflation from this growing economy.

The U.S. Labor Department reported Friday that the U.S. economy added 200,000 jobs in January, topping economist expectations of 180,000 jobs added. Average hourly earnings posted a 0.3 percent gain for the month and an annualized gain of 2.9 percent, the best gain since the early days of the recovery in 2009.

December’s nonfarm payrolls increase was revised upward to 160,000 from 148,000. The Labor Department also revised upward its December wage reading to 0.4 percent from 0.3 percent.

The 30-year Treasury bond yield touched 3.079 percent, its highest since March, following the report.

At the latest reading, the 10-year note was higher at around 2.85 percent at 2:26 p.m. ET, while the yield on the 30-year Treasury bond was also higher at 3.09 percent. Bond yields move inversely to prices.

The rising yields raised concern that higher borrowing costs could derail the economy. As of Friday afternoon, the S&P 500 was on track to finish its worst week since February 2016. The Dow Jones industrial average was down more than 540 points, more than 2 percent.

“In terms of the numbers, they were relatively close to expectations, other than the wage data: Not so much in the January numbers, but the upward revisions,” said Scott Brown, chief economist at Raymond James. “I think the key issue here is that the job market is getting tighter and wage pressure will build.”

Yields also rose after the University of Michigan’s consumer sentiment index fell less than expected in January. The index fell to 95.7 last month from 95.9 in December. Economists polled by Reuters expected a reading of 95.

The yield on the 10-year German bund also rose as foreign investors continued to sell off debt. It hit a high of 0.768 percent, its highest level since Sept. 17, 2015, when it yielded as high as 0.791 percent.

Yields had been on the rise since the Atlanta Fed adjusted its GDP outlook higher to 5.4 percent in the first quarter, pushing the 10-year yield and the 30-year yield more than 5 basis points higher Thursday. The Federal Reserve signaled inflation was set to rise in its Wednesday statement, although it kept its benchmark rate unchanged.

The 10-year yield rose 31 basis points in January, its largest monthly rise since November 2016, when the yield climbed 53 basis points.

[ad_2]

Source link