[ad_1]

Google parent Alphabet Inc.’s fourth-quarter profit missed analysts’ estimates, hobbled by rising payments to web-search partners, higher marketing expenses and troubles at YouTube that weighed on its advertising business during the holiday quarter.

Alphabet reported a hit to earnings related to taxes owed on overseas cash following recent changes to U.S. law. This $9.9 billion tax expense resulted in a net loss of $3.02 billion, or $4.35 a share, the company said Thursday in a statement. Before that cost, profit was $9.70 a share, falling short of the average analysts’ projection of $10.04. Alphabet shares slipped about 2.7 percent in extended trading.

Traffic acquisition costs, payments to phone makers and web browsers, rose to $6.45 billion, or 24 percent of Google’s overall ad revenue. Google has attributed the surge in that expense to the rising number of ads it runs on YouTube, mobile devices and automated systems, which require sharing more money with partners. Alphabet’s total sales, minus TAC, rose to $25.9 billion, in line with the average analyst projection of $25.6 billion, according to data gathered by Bloomberg.

Investors have been watching for answers about the impact of turbulence at YouTube on Google’s growth. Advertiser outcry over offensive content on the massive video site started in early 2017 and then resurfaced in the fall, after grotesque videos were spotted on YouTube’s channels for children. Several marketers paused spending to avoid having their spots run alongside the content in question. Google doesn’t break out YouTube sales.

YouTube introduced a series of policies to appease these concerns in January, including the manual vetting of videos in the premium package for advertisers. Those measures may spell further expenses for Google, Colin Sebastian, an analyst at Robert W. Baird & Co, wrote in a note before earnings.

“Overall on YouTube, we are doing a lot to protect the ecosystem,” Chief Financial Officer Ruth Porat said in an interview following the report. “We are really proud of the ongoing strength of the business and overall revenue growth across all regions.”

Despite the steady growth in Google’s ad sales, it continued to struggle with lower ad rates, primarily from the rise in mobile ads. In the fourth quarter, cost-per-click fell 14 percent. In recent months Amazon.com Inc. has expanded its ad engine aggressively, aiming for many of the same digital budgets that Google gets.

“You still have a fairly substantial competitive threat from a new entrant,” Norm Johnston, head of WPP’s Mindshare, said after Google’s report. “It’s a bit disconcerting that they can’t stabilize mobile search.”

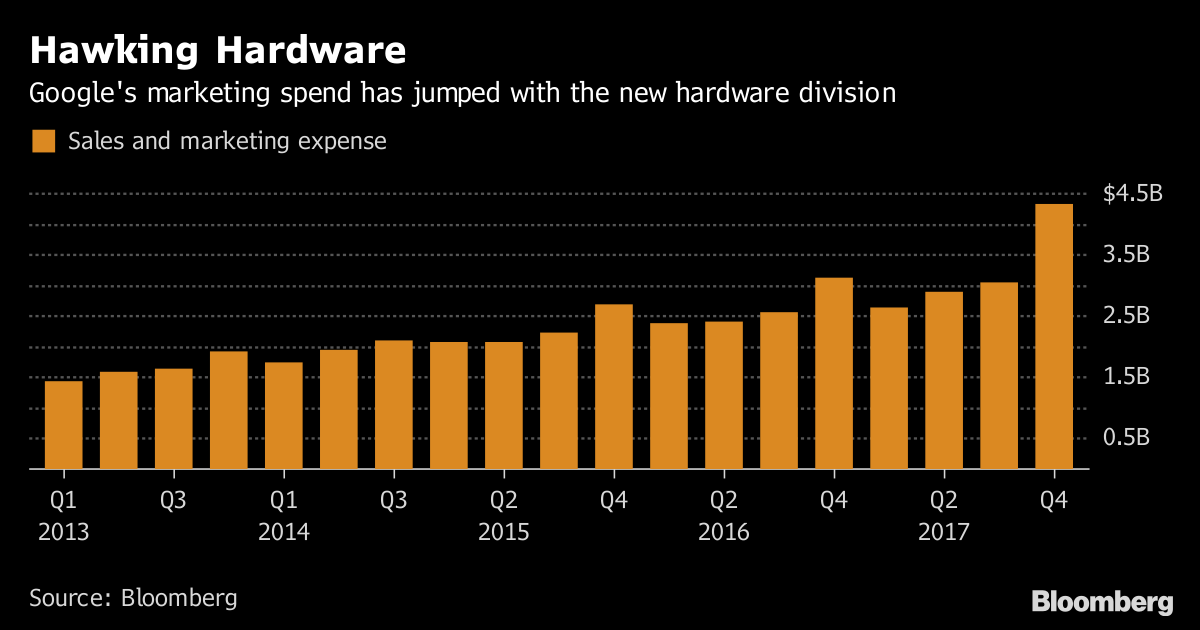

Another weight on margins comes from the amount Google has poured into hawking its Pixel phones, smart speakers and other devices. Sales and marketing expenses rose to $4.3 billion, or 13 percent of overall sales.

Hawking Hardware

Google’s marketing spend has jumped with the new hardware division

Source: Bloomberg

Beyond ads, Mountain View, California-based Alphabet posted some strength in its other divisions — although not yet from its more ambitious units like self-driving cars. The company doesn’t disclose figures from cloud-computing or hardware sales, but those divisions, lumped into Google’s Other Revenue, grew 38 percent to $4.69 billion in the fourth quarter.

On a conference call, Google Chief Executive Officer Sundar Pichai said cloud is now a billion-dollar business every quarter, and noted that hardware sales more than doubled in 2017.

During the quarter, Google’s cloud arm announced two major partnerships, with Salesforce.com Inc. and Cisco Systems Inc., to spread the search company’s data storage and apps services to more customers. Those efforts are attempts to catch Amazon and Microsoft Corp., the cloud market leaders.

Alphabet’s Other Bets category, which includes its Fiber Internet and Nest home devices, posted $409 million in revenue, with an operating loss of $916 million.

The company also named director John Hennessy as chairman, replacing Eric Schmidt, who said in December he would step down from the role. Schmidt remains on the board. Alphabet also said it authorized a share buyback of $8.6 billion of its stock.

— With assistance by Emily Chang

[ad_2]

Source link