[ad_1]

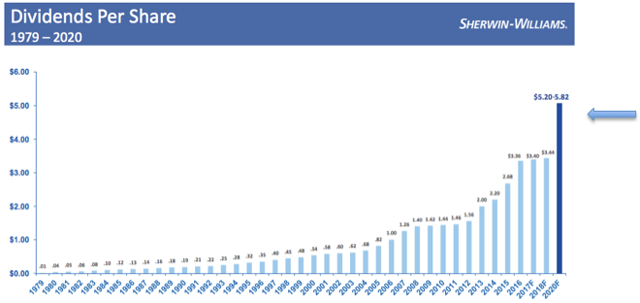

The Sherwin-Williams Company (NYSE: SHW) is a titan in the paint and coatings industry, as well as a dividend champion with 34 years of consecutive dividend increases. While dividend growth investors may have frowned at the minimal 1.2% bump that was Sherwin’s most recent dividend increase – the reality is that the Valspar addition will unlock immense earnings and dividend growth for Sherwin-Williams. We will look at the current state of Sherwin-Williams, where investors can expect the business to be performing at in a few years, and whether the recent drop in share prices from this week’s market correction marks a good buying opportunity for investors.

A Strong Presence In A Competitive Industry

Sherwin-Williams holds competitive market positions throughout the paint and coatings industry via an expansive brand portfolio.

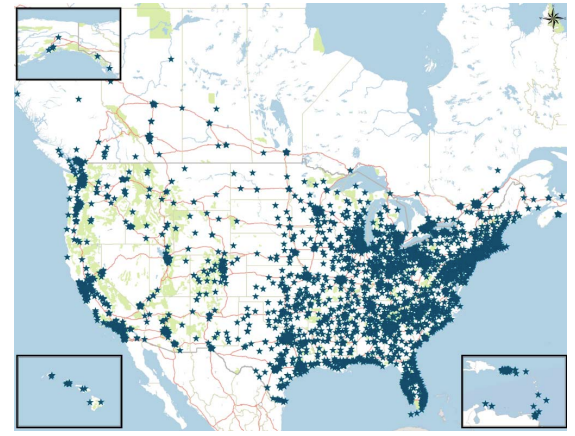

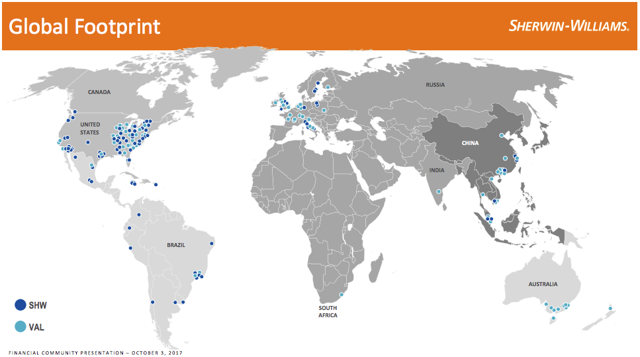

The bread and butter of Sherwin-Williams is currently its extremely robust presence in the American and Canadian markets. With approximately 4,268 stores in North America, Sherwin-Williams has extensive coverage across the market. The Valspar brands are also partnered with Lowe’s Companies (NYSE: LOW), giving additional domestic exposure.

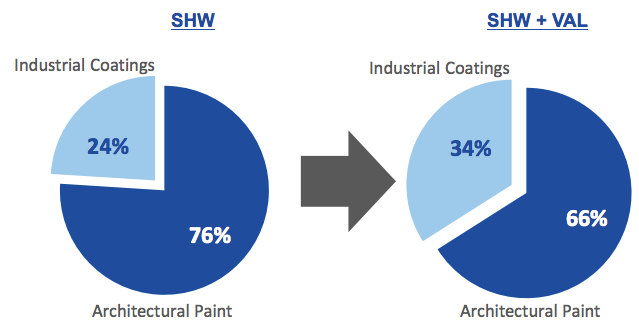

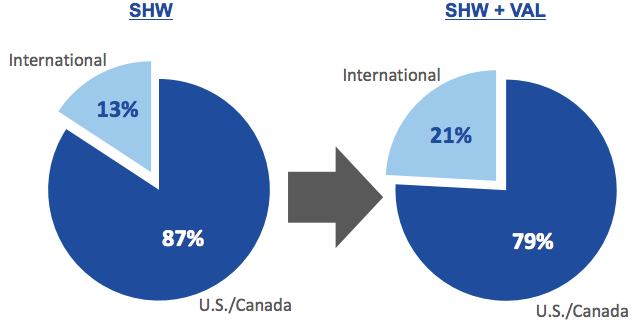

Now that the company has closed on its acquisition of former competitor and fellow dividend growth stock Valspar, the company has diversified itself both in product mix, and geography.

One of the most notable benefits of the Valspar acquisition is the added presence in the Asia/Pacific markets, where demand for paints and coatings have the highest growth rates (more on that later).

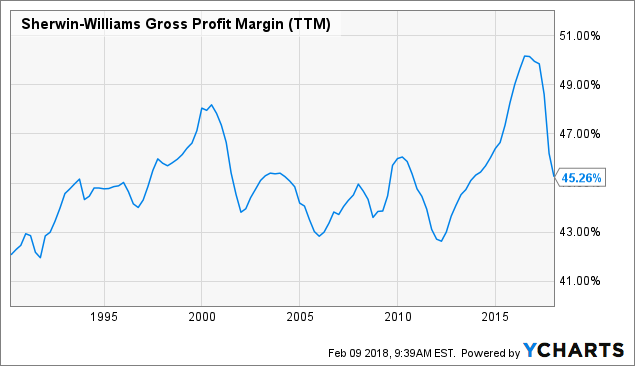

Selling Paint, Generating Cash Flows

Have you ever referred to something as being worst than “watching paint dry”? If you knew how much money the paint business can make, you certainly would think twice about that expression. It turns out that a company such as Sherwin-Williams can make paint and sell it for a bit more than it costs to make. The margins of Sherwin-Williams are very healthy.

SHW Gross Profit Margin (TTM) data by YCharts

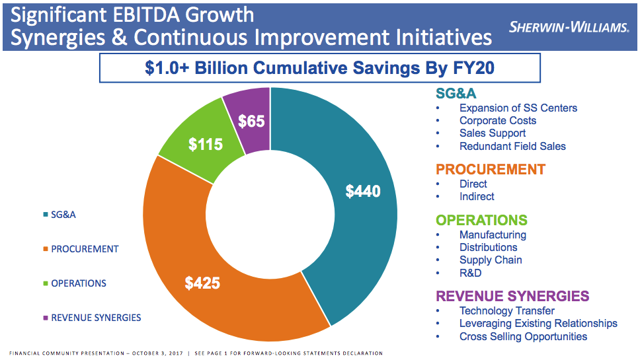

Margins should only continue to improve as Sherwin-Williams has yet to realize many synergies from the Valspar deal.

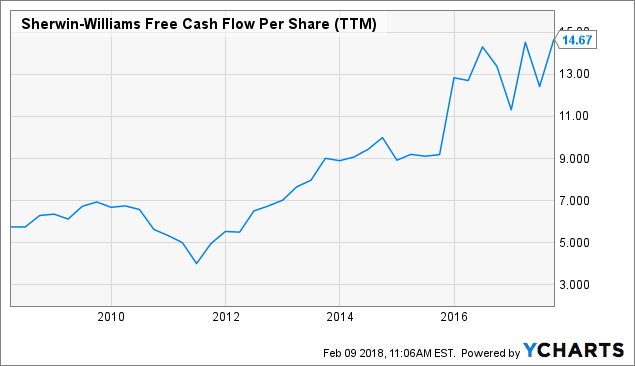

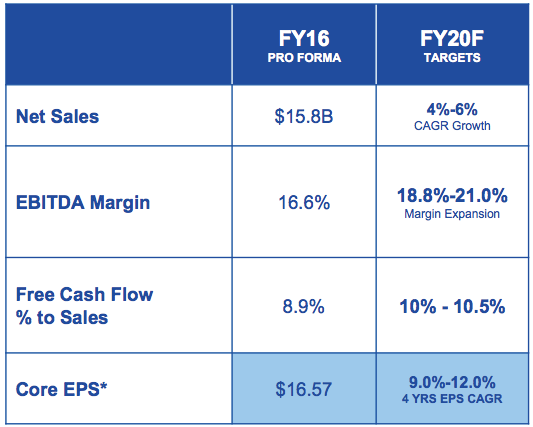

Sherwin-Williams is continuing to grow its top line, with 4-6% sales growth per annum forecasted through fiscal year 2020. This top line growth combined with improving margins should continue to push free cash flow growth higher.

SHW Free Cash Flow Per Share (TTM) data by YCharts

A Brief Reset Period, Then A Dividend Boon

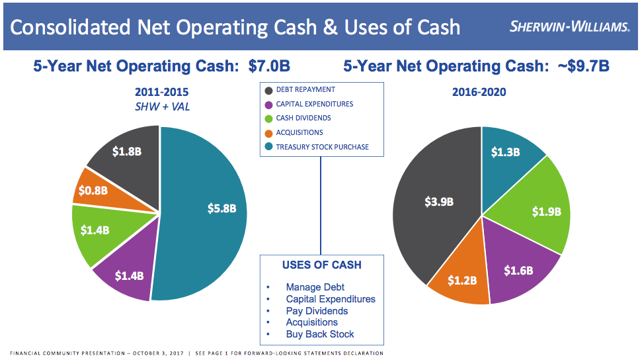

Despite this robust growth, management is going to be diverting its cash flows to “reset” the company financially after the Valspar deal.

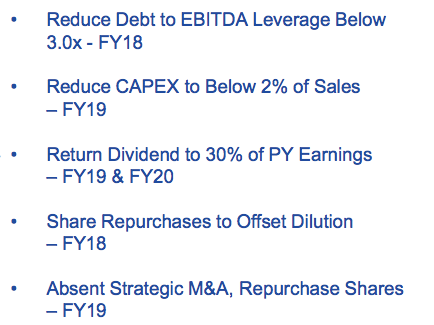

While the company has been aggressive in buying back stock throughout the past decade, management is diverting most of that cash to paying down debt to restrengthen the balance sheet. The buybacks are being drastically scaled back, as will the growth of its dividend. While this may be upsetting to short-term investors, those with a multi-year time frame may be wise to use these years to accumulate shares.

As the balance sheet recovers, the buybacks and dividend growth will come back online.

This will result in a sort of “catch up” mode that will see investors experiencing some nice payoff for their patience. The dividend will return to a 30% payout ratio of earnings, which at projected EPS in those years, will result in some massive spikes in the dividend.

Plenty Of Room For Global Expansion

While Sherwin-Williams has performed just fine “as is,” the increased foreign exposure via Valspar will ultimately become a great growth engine moving forward. While Sherwin-Williams has such a strong domestic presence, its presence on a global scale still leaves a lot of room for growth.

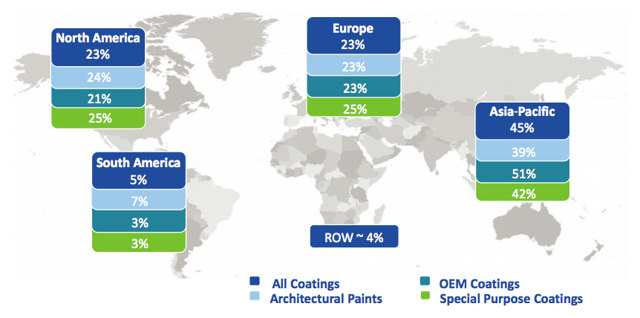

There are still minimal footprints throughout the rest of the world. Emerging markets such as South America, Africa, the Middle East, and India are virtually untapped. The below map divides the global market into dollars by regions:

We can see that the domestic market has been very strong for Sherwin-Williams, but is still only a quarter of the global market. The European market is equal to North America in market size, but Sherwin’s presence here is minor in comparison. The real driver, however, is the Asia-Pacific market. This market represents almost half of the global market, making the Asia-Pacific exposure from Valspar a critical piece of the puzzle for long-term growth. Despite being the largest global market, the Asia-Pacific region is also forecasted to grow the most over the next five years with demand projected to grow at 6% CAGR. Look for Sherwin-Williams to take advantage by attacking this market over the next few years.

So Where Could Things Go From Here?

I see the potential for immense upside to shares as the company reboots its balance sheet by fiscal year 2020.

Sherwin-Williams is forecasting 2018 earnings at approximately $19 per share excluding one time charges of over $3 per share related to acquisition costs, and one time items. If we extrapolate out at the low end of growth guidance, 2020 earnings per share would come in at around $22.57 per share. If buybacks pick up again, and boost us to the high end, we could see as much as $23.83 per share. Again these are not firm predictions, rather some simple run rates based on management’s forecasting. At historical average earnings multiples of 23X, shares could trade at between $519 and $548 per share in fiscal year 2020. The dividend will jump to catch up to its goal of 30% of TTM earnings, and then grow at a consistent 9-12% rate consistent with earnings growth. This type of performance over long periods of time are what make Sherwin-Williams such a strong wealth generator.

How feasible is it that the business performs at the forecasted growth rates of 9-12%? I find the figure quite obtainable. While the US and Canadian channels are strong, I find Sherwin’s strategic focus on the Asian market to be where the upside is in the coming years.

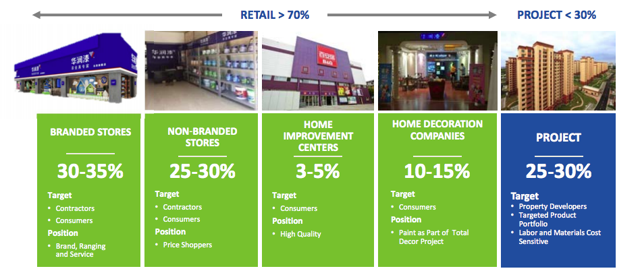

I see Sherwin’s global strength of scale to aggressively expand throughout the market as a strong competitive advantage in a fragmented Chinese market that is quite “up for grabs”. With only 8% of Sherwin-Williams’ paint sails coming from China, there is a lot of room for market share growth.

The majority of this growth will come through expansion in retail channels, something that Sherwin-Williams has an excellent track record of. Sherwin has been able to amass a large company branded store presence in the US and Canada, while simultaneously building retail relationships with nationwide chains such as Lowe’s. Given Sherwin’s success at building this model in the US, I am confident that results will be able to be reasonably duplicated in the Chinese market over time.

In addition to market share opportunity, remember from earlier in the article that this region makes up roughly half of the global demand for paints and coatings, and the Chinese economy is consistently expanding at a mid single digit rate. These roll outs don’t happen overnight, so I don’t anticipate growth being “explosive”. However, I agree with management’s target of mid single digit sales growth over a sustained period of time. These markets take years to build out, and mature. With so much work to be done on Sherwin’s part, I see this as a primary growth driver looking years into the future.

When you combine this top line growth with expanding margins and eventual buybacks, I find that the inside track to 9-12% earnings growth is a pretty logical leap to make.

Potential Risks

No investment comes without risk. Without risk, there would be no upside. While I view Sherwin-Williams as a very strong business model (aka having a wide “moat”), there are a couple of potential factors that could negatively affect projected growth estimates through 2020.

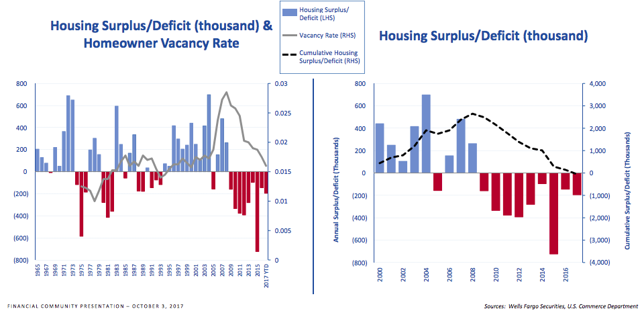

The largest risk to growth is the potential reversal of macroeconomic catalysts in the United States. Simply put, Sherwin-Williams is benefiting from both a hot housing market, and performing economy.

A shortage of supply is continuing to heat up the real estate market. How does this affect Sherwin-Williams? In market conditions such as these, more homes will be manufactured, and existing homes are being remodeled due to both inventory turnover, and homeowners opting to refresh their homes (instead of buying due to high home prices). This is a boon for Sherwin-Williams. A strong economy is also good for growth. A strong economy means products are being manufactured, automobile volumes increase, all good for Sherwin’s industrial coatings division. Remember, the majority of Sherwin’s revenues come from the US. If these trends reverse – say we enter a recession between now and 2020, that would obviously provide a steep headwind to the growth Sherwin-Williams is forecasting.

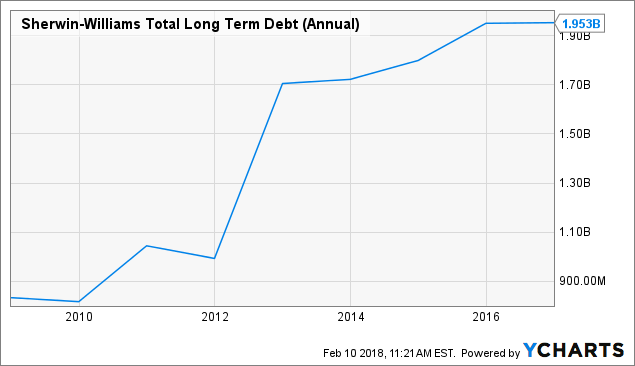

Sherwin-Williams has also seen its debt rise from mergers and acquisitions, most notably the Valspar deal. With interest rates rising the way they have recently, these higher rates make the debt more expensive to service. Refinancing or taking on additional debt will be more cost prohibitive for Sherwin-Williams. I am not as worried about rates as I would be about a slowing economy however. Sherwin’s plan to scale back buybacks and dividend growth should free up enough cash to service this debt regardless of rates. $2B is debt is not enough to over leverage Sherwin-Williams based on the $1.6B in operating cash flows it has produced over the past 12 months alone.

SHW Total Long Term Debt (Annual) data by YCharts

Are Shares A Buy?

As the stock market rally since the election has pumped up the market – industrials such as Sherwin-Williams among them, shares have been hit hard by the correction this week. Shares touched at higher than $435 per share at one point, only to fall all the way down to $387 per share as the DJIA saw multiple 1,000 point drops in a single week.

If we use true earnings for 2017 of $15.07 per share (stripping out one time items and charges), the current price drop has put shares at little more than 25X earnings. After a large drop (considering the highs of $435) put shares at 29X earnings, the stock is now trading at a bit more reasonable of a range. I don’t typically refer to 25X earnings as an entry point, but Sherwin-Williams is a true blue chip industrial with a lot of growth ahead of it. These types of stocks are typically held at a premium by the market, as indicated by a historical valuation of 23X earnings.

Whether shares are a buy today, is up to each prospective investor. With rates rising, we have entered a period of increased volatility in the markets. The price of shares has come down drastically, but it would be impossible to call a bottom. Shares are still higher than historical averages, although a long term investor would likely do well over time. For those content on holding shares to 2020 and beyond, this is a good range to accumulate shares. Depending on what the market does, continued selling may push shares lower still. The flip side being that the bull market continues, resulting in a run back up to the $400s in short order.

Note: Unless otherwise noted, all graphics are property of The Sherwin-Williams Company.

Disclosure: I am/we are long SHW.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link