[ad_1]

I warned readers before this week’s oil trading got underway that oil prices may go to hell in a hand basket. And WTI crude futures prices logged their worst weekly performance in two years.

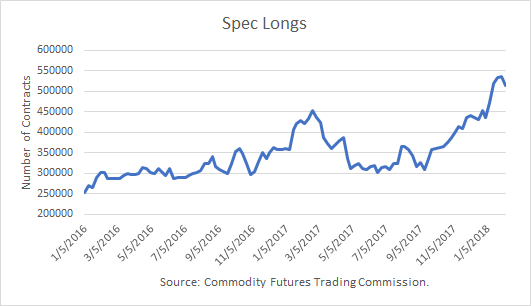

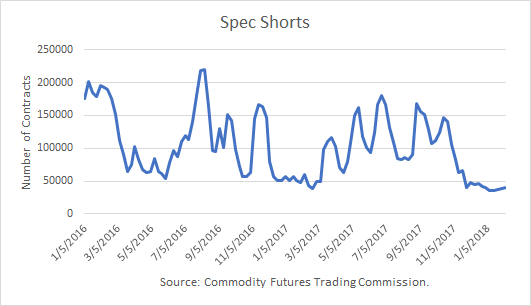

For me, the writing was on the wall when the EIA reported that November crude oil production had risen by 384,000 b/d (401,000 b/d with October’s revision), far greater than the weekly data for the same period. The other key factor was the record length of speculative long positions combined with the very low speculative short positions. All that was needed was a catalyst to start a landslide. Once prices start falling, it would bring a wave of selling as losses begin to mount.

On Wednesday, as I had expected, the EIA revised up its weekly estimate of crude production by 338,000 b/d from the prior week. Prices broke below $59/b on Friday after Baker Hughes reported that oil-directed drilling rigs rose by 26 in the week ending February 9, the largest jump in a year. The rig increase portends much higher production increases in months to come.

Also on Friday, Gazprom Neft Chief Executive Alexander Dyukov said that “an adjustment of the global oil production cut deal between OPEC and some non-OPEC members, including Russia, was possible in the second quarter of 2018.” Dyukov also said that he hoped that the countries would agree to increase production. No doubt Russia and KSA are getting nervous about rising U.S. crude exports taking their market share. It was reported that U.S. oil was sold to the United Arab Emirates in December!

Finally, President Trump signed a budget on Friday that contains a provision to slash the U.S. Strategic Petroleum Reserve in half, auctioning off the barrels. While I’m a proponent of the SPR, I think it makes sense since it will still be 300 million barrels, and there has never been a need for more than 35 million at any time since it began to fill in 1977. The drawdown will be through 2027, and so it will not have a material impact on the global supply/demand balance, but it sends the message that the peak oil demand era is coming to a close in the not too distant future. I also got an email from Harvard University this week saying that it plans to end its use of fossil fuels on campus by 2050.

What I think the events of this week show is that the U.S. shale oil’s lagged response to the higher price regime is just starting. Those predicting $70 and higher have grossly underestimated the supply effect of higher prices. As Michael Lynch recently pointed out in his Forbes article, “Analysts who make concrete predictions tend to be popular, especially when their predictions are optimistic (the buyside bias) while those who talk about different outcomes are dismissed…” I would go a step further and say “hated” (by many in the long-only crowd), instead of “dismissed,” by the number of abusive comments in articles that predict lower oil prices. (Fortunately, Seeking Alpha has moderators who weed them out to keep the discussion at a more professional level.)

Conclusions

As I’ve explained before, I do not trade based on a price target. I have my own algo I call Vertical Risk Management. I have found that prices can and often do go much higher or lower than seems rationale. That’s because traders reposition based on greed and fear. VRM is my attempt to deal with the effects of greed and fear, for which I have performed daily trading simulations going back many decades.

The latest CFTC Commitments of Traders report is for February 6. Prices have fallen hard in three sessions since then. As of Tuesday, spec long positions had just begun to drop, and spec short positions had barely started to rise. What this implies to me is that the correction had only just begun.

For holders of the The United States Oil ETF (NYSEARCA:USO), now is a good time to reconsider a “long-only” stance in the oil market, which has been a financial disaster since 2014.

Are You Pleased With Your Energy Sector Returns?

If not, perhaps you should consider Boslego Risk Services, a premium service in Seeking Alpha’s Marketplace. My approach is to go long, short, or be on the sidelines.

I provide a model portfolio which is updated daily. The trades are quickly posted as performed.

Learn more about the service by clicking here. There is an active membership chat room to talk about the oil market and strategy.

The monthly and annual pricing options are described here. You may also read reviews posted by members here.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link