[ad_1]

Rio Tinto Group’s best profit in three years and a record dividend is yet another sign that miners are reaping the benefits of a surge in commodity prices.

Yet the sheer size of Rio’s cash flow is starting to raise another question: how else will the world’s second-biggest mining company invest all its money? The company has so far focused on rewarding shareholders and on Wednesday, it promised a full-year dividend of $5.2 billion and an additional $1 billion stock buyback.

But there are some hints that Rio could use its fortress of a balance sheet to start investing in other mining assets. Chief Executive Officer Jean-Sebastien Jacques said the company is watching for deal opportunities and screening for new commodities with a new ventures unit.

Cash Cow

Rio Tinto’s mining assets are generating the most cash in three years

Source: Rio Tinto, Bloomberg

“We have got a lot of firepower in our balance sheet,” Chief Financial Officer Chris Lynch said in a phone interview. “We’ve got good capacity, we are looking at a lot of different things — but we are going to stay disciplined.”

Outside of core commodities like copper, iron ore and aluminum, “we’d just need to see something that we can see ourselves being successful in. That doesn’t preclude many things — in the main, we’d be confident to back our ability in most mining situations,” Lynch said.

Rio, which delivered almost $10 billion of cash returns to shareholders in 2017, could improve on that as cash builds. “The company is in very good shape, and I certainly wouldn’t rule out the idea of even better returns next year,” he said.

Arizona Copper

In December, Rio approved spending $368 million to continue the future development of the Resolution copper project in Arizona, a joint venture with BHP Billiton Ltd., according to the statement today.

Shareholders may be willing to support Rio if it moves to add a different commodity to its portfolio — mainly based around copper, iron ore and aluminum, according to a report from UBS Group AG. Rio dropped out of the bidding for a $5 billion stake in Soc. Quimica & Minera de Chile SA, one of the world’s top lithium producers, people familiar with the matter said last month.

“We think the market is ready, but the price paid is key,” said Glyn Lawcock, a Sydney-based UBS analyst, in a research report on Monday. Rio is “down to basically three commodity pillars, is the market ready for Rio to take on a fourth?”

Other analysts say the company will likely stick with its current strategy. The shares added 0.3 percent to 3,855 pence in London trading on Wednesday. In the past year, the stock has risen 12 percent.

“It’s a very consistent message and strategy which shareholders will like,” said Richard Knights at Liberum Capital Ltd. “Given the multi generational nature of their asset base, mainly iron ore and aluminum, they can keep this up a long time.”

Read: Pile-of-Cash Dilemma for Mining Industry Once Crippled by Slump

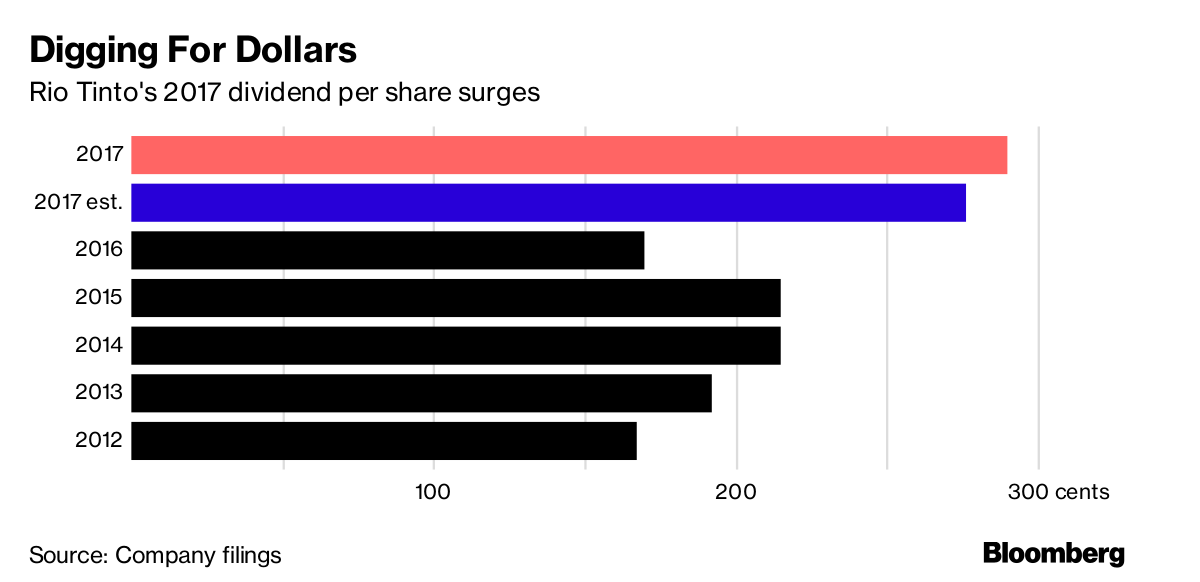

Digging For Dollars

Rio Tinto’s 2017 dividend per share surges

Source: Company filings

The company reported operating cash flow of $13.9 billion for 2017, up 64 percent from the previous year. Underlying profit was $8.6 billion in underlying profit for 2017, a 69 percent jump from 2016. The results were in line with estimates compiled by Bloomberg.

For more details on Rio’s earnings, click here.

Investec’s Hillcoat said it’s unlikely that Rio will embark on any “multibillion-dollar expansions” to chase M&A growth or pay a premium for other commodities, such as copper, given the industry’s history of overspending.

“The only way to rebalance their portfolio is to take on additional growth in other commodities like copper, either through acquisitions where they’ll have to pay a premium or through expansion, but they don’t really have too many meaningful growth options there,” he said.

— With assistance by Matthew Burgess, and Thomas Biesheuvel

[ad_2]

Source link