Serving tech enthusiasts for over 25 years.

TechSpot means tech analysis and advice you can trust.

What just happened? Disney has just revealed how many people are signed up to the ad-supported tier for Disney+, though the announcement was unintentional. It was company CEO Bob Iger himself who made the gaffe, though he did add – a little too late – that “I don’t know if I was supposed to disclose those numbers.”

During Disney’s earnings report for the fourth financial quarter of 2024 yesterday, a Wall Street Journal analyst asked Iger about Disney+’s growth outlook and pricing strategy.

Iger revealed that 37% of US-based Disney+ users were signed up to its cheapest, ad-supported tier. Slightly more than the global figure of 30%.

While the CEO didn’t reveal exact numbers, there are 56 million Disney+ subscribers in the US. If 37% are on the ad-tier, it means that around 20.7 million have their shows and movies interrupted by ads. With 122.7 million global subscribers and 30% on the ad tier, it means 36.8 million Disney+ customers are saving money at the cost of ad intrusions.

Graphs by App Economy Insights

Compared to the $10 per month Disney charges, Netflix’s $7 ad-supported tier is $3 cheaper. Deadline reports that Netflix has 70 million people on this plan globally. That’s more than Disney+, but with worldwide subscriber numbers of 282.7 million, it means roughly 25% of Netflix users opt for ad-supported.

Back in December 2023, 5% of Netflix’s US subscribers were being shown commercials, compared with 17% for Disney+. It appears a lot more people have chosen to save money and go ad-supported over the last year.

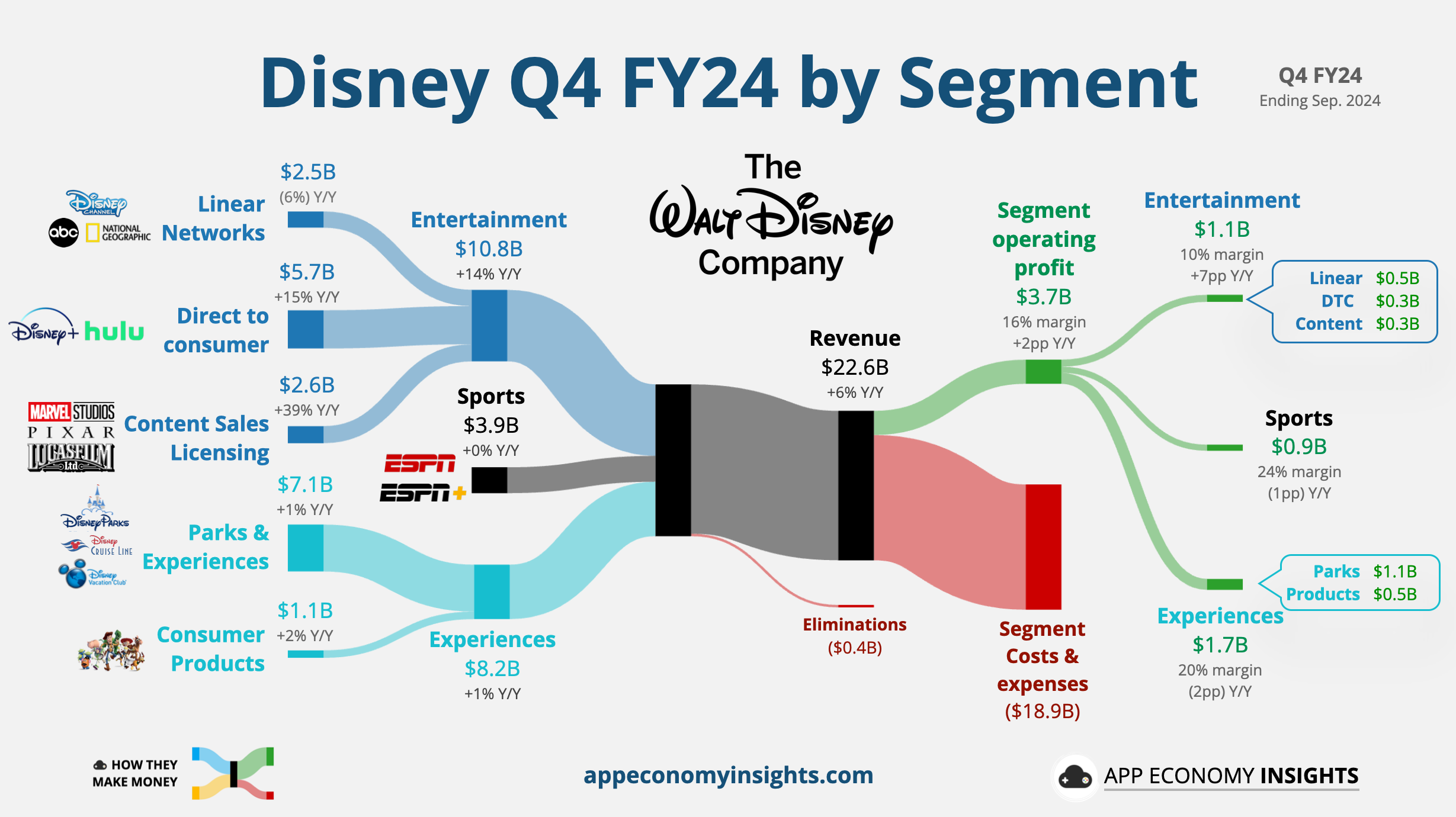

Iger is unlikely to be too upset about his accidental reveal, given how well Disney performed over the quarter. Deadpool & Wolverine and Inside Out 2, the two top movies of 2024 so far, both of which grossed over $1 billion, helped push revenue up 6% year-on-year to about $22.57 billion, beating Wall Street analysts’ expectations.

Disney’s subscription services were also a bright spot: it now boasts 174 million Disney+ core and Hulu subscriptions. Disney+ global subscriptions alone are up 4.4 million compared to the previous quarter, while Hulu gained 900,000 more subs. Streaming revenue rose 15% to $5.78 billion, and ad sales rose 14%. Disney said its gains came from subscription price hikes and lower marketing costs.